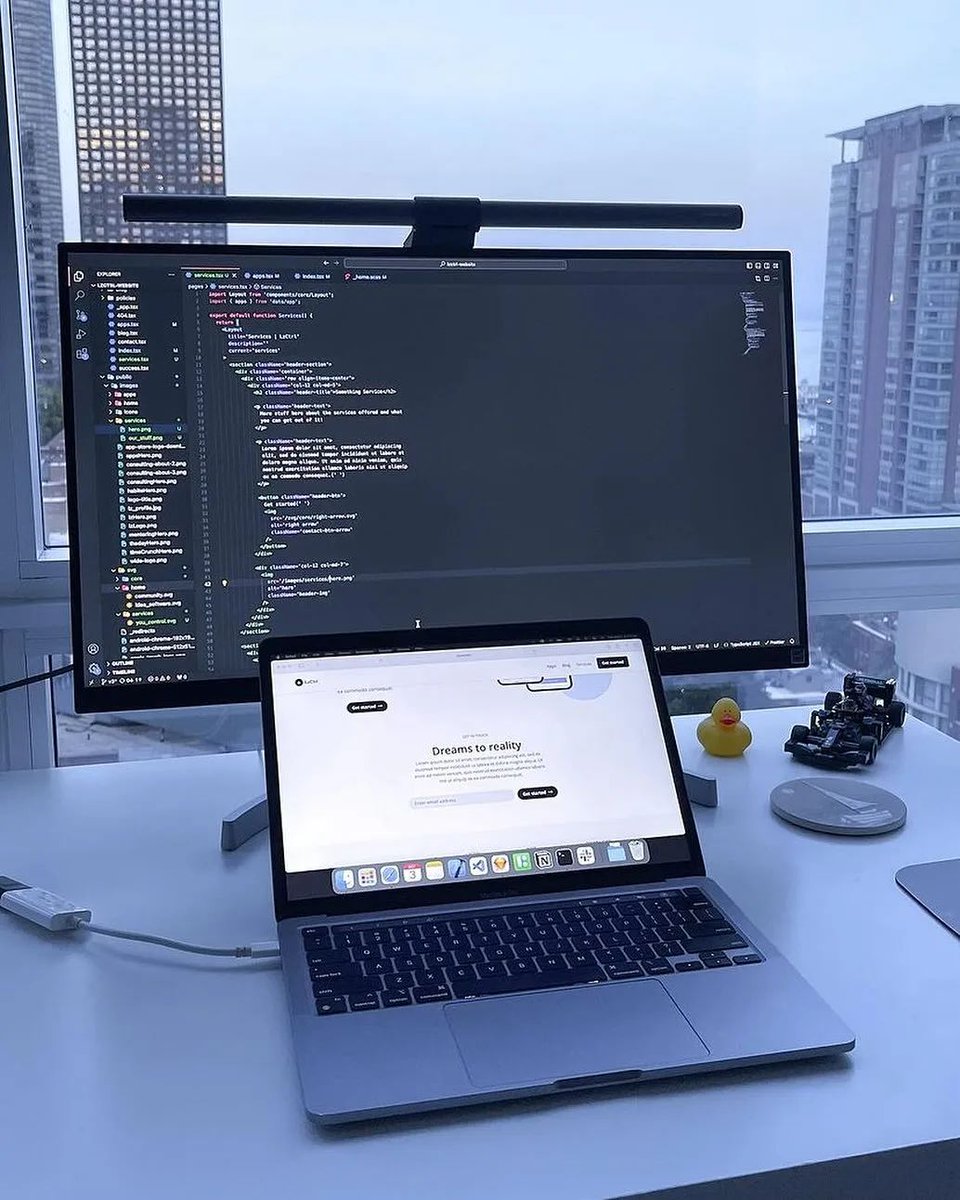

XLCS Real Estate Full Cost Calculation Template - Non-Standard Financing Module Introduction

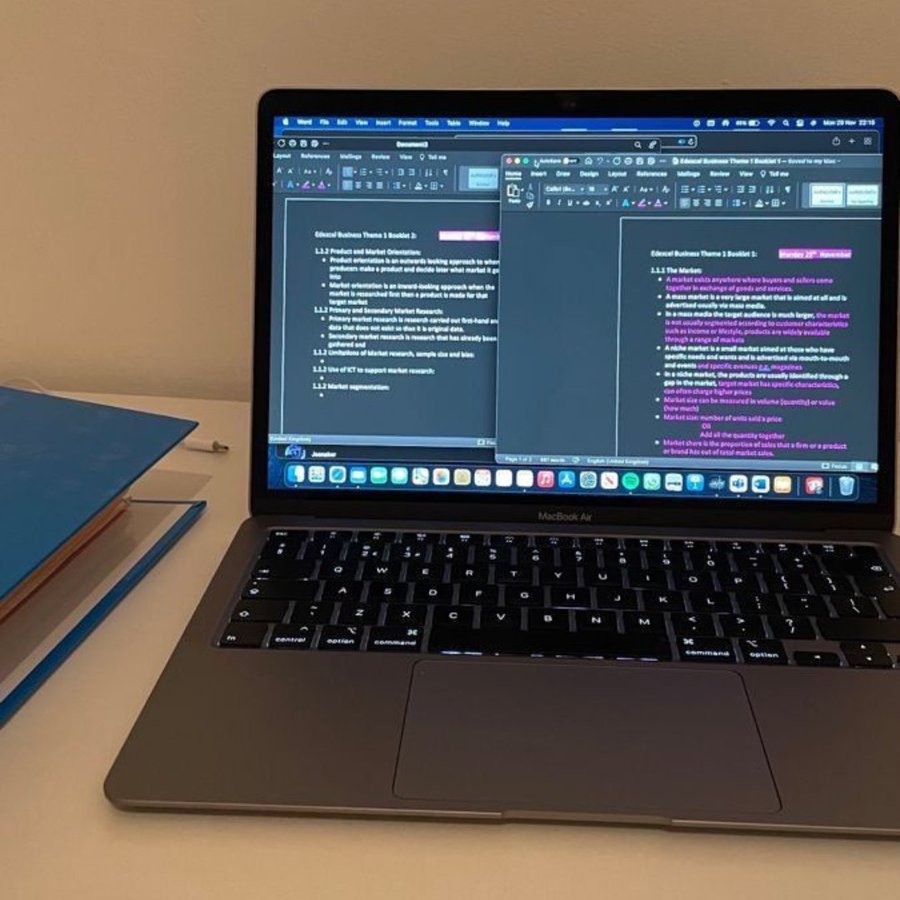

XLCS Real Estate Project Full Cost Calculation Template - Non-Standard Financing Module Display

Loan Trigger Conditions:

When the cumulative cash balance is negative and its absolute value exceeds threshold T1 (i.e., the minimum amount for each financing)

Each loan amount takes the smaller value between the “absolute value of the current funding gap” and “land cost” (i.e., the maximum amount for each financing)Repayment Handling:

Normal repayment: Principal is repaid in full upon loan maturity

Early repayment: All outstanding loans are repaid early with actual interest calculated when reaching the liquidation month. The 6-month no-gap early repayment logic triggers when no funding gap is detected in the next 6 monthsInterest Calculation: Monthly interest is calculated based on the remaining principal**

Non-Standard Financing Module User Guide

📌 Core Features

- Smart Financing Trigger: Automatically monitors cash flow gaps and dynamically calculates financing needs

- Triple Repayment Mechanism:

- ✅ Regular maturity repayment (by loan term)

- 🚨 Forced repayment at designated liquidation month

- 💰 New 6-month no-gap auto early repayment

- Dual Environment Compatibility: Fully supports MS Office/WPS

⚙️ Parameter Configuration Guide

Mandatory Parameters

| Parameter Location | Format Requirement | Example | Description |

|---|---|---|---|

Cell R1 |

Decimal percentage | 0.05 | 5% annual interest rate |

Cell V1 |

Integer | 12 | Loan term (months) |

Cell T1 |

Numeric (10k CNY) | 5000 | Financing trigger threshold |

Optional Configurations

Name Manager Settings:

- “Land Cost” → Points to single loan upper limit (10k CNY)

- “Liquidation Month” → Points to forced liquidation month (blank=disabled)

🚀 Operational Workflow

Data Preparation Phase

Ensure Cash Flow Table 10 exists

Input cash flow data continuously starting from cell G21

Parameter Setting Phase

‘ Example parameter setting code (actual cell operations)

Range(“R1”) = 0.05 ‘ 5% annual rate

Range(“V1”) = 12 ‘ 12-month term

Range(“T1”) = 5000 ‘ 50M CNY trigger threshold

Execution

Click “One-Click Generate Non-Standard Financing” button to run macro

Monitor real-time progress in status bar

📊 Output Results

| Output Location | Data Content | Sign Rule |

|---|---|---|

| Row 31 | Institution Loans | Positive = inflow |

| Row 32 | Principal Repayment | Negative = outflow |

| Row 33 | Interest Payment | Negative = outflow |

⚠️ Important Notes

- Interest rates must use decimal format (5%→0.05)

- Default upper limit is 800M CNY if “Land Cost” not set

- Liquidation month=0 disables the feature

- Backup data before first run

🔍 Debugging Tips

‘ Check Immediate Window (Ctrl+G) for:

- Detailed loan issuance/repayment records

- Liquidation event trigger logs

- Funding gap analysis data

📅 Version: 5.7.17_WPS Optimized Edition

🛠️ Last Updated: 2025-03-09

📧 Technical Support: admin@fdc.sd

Official Websites:

http://fccs.cc

http://fckcs.cn

http://fckcs.com

http://fdc.sd

http://fccsz.com

http://cskits.com

Support:

http://xlcs.de/

Leave comments or email: mailto:admin@fdc.sd

Non-Standard Financing Module Display: